Links to news items from July 2013 to [earlier in] October 2016 may be found on the Archived News page.

Me (February 23, 2017)

Updated below: 3/23/17 and 3/27/17 {thrice}.

|

| Image source |

The press release also noted Eric's bridge loan and investment commitment to the Company. See Bridge Building (February 21, 2017).

Updated (3/23/17).1: Provectus issued a press release and made an 8-K filing regarding my and others involvement in a securities transaction with the Company, and my and others involvement with the Company.

Updated (3/27/17).2: Seeking Alpha ("SA") itself/themselves published blog post "Provectus Biopharmaceuticals Announces Terms Of Definitive Financing Commitment" under my name today. The SA version is here. See Returning to Seeking Alpha, sort of (January 21, 2015) on the blog's Archived News III page. My SA account has been dormant since October 2013; I have not published articles or made Instablog posts there myself, nor have I replied to comments under articles SA publishes since.

Updated (3/27/17).3: Emails this morning to SA are below.

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Image source |

Bridge Building (February 21, 2017)

Provectus made an 8-K filing regarding a bridge loan extended to the company by Chief Technology Officer and a co-founder Dr. Eric Wachter, PhD. Notable terms include (but are not limited to):

- Up to $2,500,000 in principal,

- A 6% annual interest rate,

- The loan is unsecured,

- A maturation date of May 22nd (i.e., 90-day term), and

- Principal and accrued interest payable at maturation, or convertible into a "qualified equity financing" (defined in the document).

Provectus also made a prospectus supplement filing to update the rights offering document and process regarding Eric's bridge loan.

H/t InvestorVillage poster Warlord:

A. PV-10 vs Chemotherapy or Oncolytic Viral Therapy for Treatment of Locally Advanced Cutaneous Melanoma, Oklahoma Cancer Specialists and Research Institute was added as a trial site (not yet recruiting). The principal investigator is Dr. Edward Yob, DO. CT.gov changes for this iteration are here.

|

| Click to enlarge. Image source (without dotted line/box). |

|

| Click to enlarge. Image source (without dotted line/box) |

The P Word (February 16, 2017)

Takeaway #1: '165 combination therapy daughter patent application (continuation of the combination therapy patent, jointly assigned to Provectus and Pfizer), which received a final rejection from the US PTO, has been advanced in the US PTO intellectual property protection process by Provectus. This step was undertaken on January 13th, and I had missed it.

|

| Click to enlarge. Image source: Application on USPTO PAIR website. |

This blog news entry is the expected follow-up to Patently Obvious (January 6, 2017) and You down with I.P.P.? (December 14, 2016). I previously noted under Hey batta batta batta swing batta batta (October 19, 2016) on the blog's Archived News VI page that in tracking (diligencing) Provectus' intellectual property portfolio, all three daughter patent applications -- that is, all continuations of August 2015-awarded patent Combination of local and systemic immunomodulative therapies for enhanced treatment of cancer (#9,107,887) -- received final rejection notices from the US PTO; '309 (application #14/748,579) on September 23rd, '318 (#14/748,634) on October 12th, and '165 (#14/748,608).

Takeaway #2: '318 combination therapy daughter patent application (a continuation of the combination therapy patent, also jointly assigned to Provectus and Pfizer) has been further advanced: A request for continued examination was made on February 10th.

|

| Click to enlarge. Image source: Application on USPTO PAIR website. |

13F filings (through this writing) for the period ending December 31, 2016, per WhaleWisdom.com, showed:

- A decrease in institutional share holdings of Provectus: ~209K shares (down from 10.6 million as at September 30th, or -98% quarter-over-quarter) and 0.06% of shares outstanding* (not a fully diluted figure) (down from 4.35%), and

- A decrease in the number of filers to 8 (down from 42).

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

Updated below: 2/11/17, 2/13/17 and 2/14/17.

Provectus made two new SEC filings related to the company's conference call today. First, Provectus issued an 8-K that included the call's presentation and script. Second, the company amended the prospectus of the rights offering (i.e., Prospectus Supplement No. 1) to address/include the contents of the aforementioned 8-K.

Maxim Group's Karl Brenza noted: "The Rights Offering is currently scheduled to terminate on February 17th at 5:00 p.m. Eastern time, although management has determined, subject to board approval, to extend the expiration date of the Rights Offering to March 3, 2017. This extension of the expiration date will be announced in a press release as soon as it is approved."

Updated (2/11/17).1: Provectus issued a press release related to its extension of the rights offering to March 3rd.

Updated (2/13/17).2: The company made an 8-K filing related to the abovementioned rights offering extension, and extension press release.

Updated (2/14/17).3: The company made an 8-K filing related to procedures for foreign stockholders and certain warrant holders related to the rights offering.

"Percutaneous Rose Bengal as an Oncolytic Immunotherapy for Hepatic Metastases" (February 7, 2017)

"Percutaneous Rose Bengal as an Oncolytic Immunotherapy for Hepatic Metastases," CIO (Clinical Interventional Oncology) 2017, Hollywood, FL USA, Abstract #15831, February 2017

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

Updated below: 1/27/17, 1/30/17, 1/31/17 and 2/3/17.

Provectus issued its fifth amendment to its S-1 related to the rights offering to existing investors today. The fourth amendment is here (filed with the SEC on December 21st). As an aside, the third amendment is here (filed with the SEC on December 6th).

Updated (1/27/17).1: Provectus issued its sixth amendment to its S-1.

Updated (1/30/17).2: The company's S-1 was made effective on January 27th.

Updated (1/31/17).3: Provectus made two new SEC filings. One was the [presumably] final prospectus for the rights offering, offering up to approximately 20 million units (4 shares of common stock and 0.5 shares of Series C convertible preferred stock per unit) for $1 per unit. One was an 8-K related to the associated press release. A conference call by company management and a Maxim Group (the deal's organizer) representative to discuss the offering is scheduled for February 9th at 4:15 pm ET.

Updated (2/3/17).4: Provectus made a new SEC filing, an 8-K, which discussed certain matters related to the rights offering.

"Intralesional treatment of metastatic melanoma: a review of therapeutic options" (January 14, 2017)

Updated below: 1/16/17.

H/t regular hatter @bradpalm1:

|

| Click to enlarge. Tweet image source |

|

| Click to enlarge. Image source |

|

| Click to enlarge. Image source above |

"Intralesional therapy of melanoma patients with locally advanced metastatic disease is attracting increasing interest, not least due to its ability to lead to both direct tumor cell killing and the stimulation of both a local and a systemic immune response. An obvious pre-requisite for this type of approach is the presence of accessible metastases that are amenable to direct injection with the therapeutic agent of interest. Patients who present with these characteristics belong to stages IIIB/C or IV of the disease. Surgical resection with intention to cure is the standard of care for patients with limited tumor burden and confined spread of disease (resectable patients). However, this category of patients is at a high risk of further recurrences until the disease becomes inoperable (unresectable) or progresses to a more advanced stage with visceral organ involvement, after which the prognosis is particularly grim. Most of the intralesional treatments tested so far, including the recently approved oncolytic virus talimogene laherparepvec, target the subpopulation of patients with unresectable disease, but the possibility to use the intralesional treatment in a neoadjuvant setting for fully resectable patients is attracting considerable interest. The present article reviews approved products and advanced stage pharmaceutical agents in development for the intralesional treatment of melanoma patients."The article notes: "This paper is a Focussed Research Review based on a presentation given at the Fourteenth Annual Meeting of the Association for Cancer Immunotherapy (CIMT), held in Mainz, Germany, 10th–12th May, 2016. It is part of a series of Focussed Research Reviews and meeting report in Cancer Immunology, Immunotherapy."

|

| Click to enlarge. Image source |

Updated below (1/16/17): H/t a regular hatter for the paper itself:

"Introduction

Melanoma is the deadliest of all skin cancers [1] and its incidence has been steadily increasing over the last 30 years [2]...

The propensity of melanoma to metastasize to readily accessible cutaneous or subcutaneous locations has prompted increased interest in researching the development of therapeutic approaches based around direct injection of active agents into the metastases, which have collectively been given the name of intralesional approaches.

Patients with limited and often asymptomatic locoregional disease are the ones most likely to benefit from intralesional therapies [8, 9]. In fact, direct injection of a therapeutic agent into the tumor, while maximizing its concentration at the site of disease, is associated with reduced systemic concentrations of the drug and a more favorable tolerability profile, when compared to systemic or regional perfusion-based therapies, which normally lead to considerable toxicity. Furthermore, the local effect exerted directly on treated tumor lesions can in some instances be associated with a systemic bystander effect (termed “abscopal effect”). This effect results in the shrinkage or disappearance of non-treated lesions, some of which may even be located at distant anatomical sites...

...Recently, new promising agents for the locoregional treatment of melanoma lesions have been developed. This review will focus on those agents which have either already obtained marketing approval or are currently being investigated in registration phase 3 trials. These include talimogene laherparepvec (T-Vec, Imlygic™), rose bengal (PV-10), and Daromun (L19IL2 + L19TNF). Many other agents are being developed for intratumoral application in several indications including melanoma but they have not been investigated in controlled phase 3 studies yet; these agents and their application have also been described in excellent recent review articles [17–19].

T-Vec was approved in 2015 in the US and Europe for the treatment of unresectable stage IIIB, IIIC or IVM1a metastatic melanoma. Rose Bengal is currently being investigated in a phase 3 trial in a similar indication. Daromun is being studied in a phase 3 trial as a neodjuvant treatment prior to surgery in fully resectable stage IIIB and IIIC patients (see also Table 1).

|

| Click to enlarge |

...Novel agents: intralesional treatment of unresectable advanced metastatic melanoma patients...

Rose Bengal (PV-10)

Rose Bengal is a small molecule that belongs to the xanthene family and is a derivative of fluorescein. The compound has been in use for decades in the clinic as eye drops to stain damaged conjunctival and corneal cells and thereby more easily identify affected areas. Its potential applicability as an anti-tumor agent has, however, been recognized only much later, during a screening campaign for new photodynamic therapy agents with antineoplastic activity....

...The proposed mechanism of action is based on a selective uptake of the compound through the cell membrane of cancer cells because of its higher fluidity as compared to that of normal cells. PV-10 accumulates in the lysosomes [45], triggering lysosomal release and autolysis of the tumor cells, which is normally complete within 30–60 min. Acute exposure of antigenic tumor fragments to APCs is believed to produce the “bystander” effect observed in non-injected tumors...

Conclusions

Over recent years, there has been a radical change in the management of advanced melanoma patients with the approval of many novel therapeutic agents....

If the killing of the tumor can stimulate a tumor-specific immune response that persists after the tumor is removed, a positive impact may be expected on non-injected lesions. As the treatment with Daromun is short (4 weeks), the procedure can be performed without an unreasonable delay of surgical intervention.

Many researchers believe that the future of intralesional therapies is linked to their use in combination with the new systemic therapies, in particular immunotherapies [40, 41]. Results of the ongoing trials will tell if, in addition, the use of intralesional therapies as neoadjuvants can play a role in the therapeutic approach for resectable melanoma patients in the years to come."Clinical Trial Status Update: Melanoma P3 (January 9, 2017)

H/t a regular hatter: PV-10 vs Chemotherapy or Oncolytic Viral Therapy for Treatment of Locally Advanced Cutaneous Melanoma, Wake Forest Baptist Health has started recruiting, and the anticipated primary completion date (Estimated Primary Completion Date) was pushed back from March 2018 to September 2018 (i.e., +6 months). CT.gov changes for this iteration are here.

Patently Obvious (January 6, 2017)

Takeaway: '309 combination therapy daughter patent application (continuation of the combination therapy patent, PV-10 + targeted therapies), which received a final rejection from the US PTO, has been advanced in the US PTO intellectual property protection process by Provectus.

This blog news entry is the expected follow-up to You down with I.P.P.? (December 14, 2016). I previously noted under Hey batta batta batta swing batta batta (October 19, 2016) on the blog's Archived News VI page that in tracking (diligencing) Provectus' intellectual property portfolio, all three daughter patent applications -- that is, all continuations of August 2015-awarded patent Combination of local and systemic immunomodulative therapies for enhanced treatment of cancer (#9,107,887) -- received final rejection notices from the US PTO; '309 (application #14/748,579) on September 23rd, '318 (#14/748,634) on October 12th, and '165 (#14/748,608).

Provectus' CTO Dr. Eric Wachter, PhD, in his re-submission to the US PTO of the '309 patent application sought no ammendments to the original application, apparently arguing the result of the combination of PV-10 and systemic targeted cancer therapy is/was unexpected, thus novel, and thus patentable.

The re-submission's "Applicant Arguments/Remarks Made in an Amendment" is worth a read, and screenshots are below.

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

Response (January 2, 2017)

Updated below: 1/10/17 and 1/27/17.

Provectus' former interim CEO, and COO Peter Culpepper today filed a Schedule 13D in which he responded to his termination. See And then there were two (December 28, 2016) below.

Updated (1/10/17).1: New SEC filing. Peter filed a Form 4 yesterday, with a remark on the form of "On December 28, 2016, the reporting person, Peter Culpepper, was terminated as an officer and an interim officer of Provectus Biopharmaceuticals, Inc. (the "Issuer"). This Form 4 serves as his exit filing. No acquisitions, dispositions or other transactions involving securities of the Issuer are being reported on this Form."

Updated (1/27/17).2: New SEC filings. Peter filed an amended Schedule 13D today, attached to which he presented his slate of directors for election at the 2017 annual meeting of stockholders. An associated Schedule 14A also was filed.

December Blog Readership Stats (January 1, 2017)

Updated below: 1/3/17 {twice}.

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

Updated (1/3/17).1: Provectus issued a press release today, writing there would be a business update conference call with investors/shareholders (to address management changes) on Thursday, January 5th. I understand there will be no call, and that the issuance of the release was an error (on the part of the company's investor relations firm Porter Levay & Rose).

Updated (1/3/17).2: Provectus confirmed the cancellation of the abovementioned business update call. See this link here, and screenshot below.

|

| Click to enlarge |

Provectus terminated (fired) the company's interim CEO, and COO today, based on "...based on the results of the investigation conducted by a Special Committee of the Company’s Board of Directors regarding improper expense advances and reimbursements to..." Peter, issuing an associated press release and filing an associated 8-K. Of note [to me]:

"In the interim, Timothy C. Scott, Ph.D, will perform the functions of the chief executive officer position in his capacity as President while the chief executive officer position remains vacant."Quite quiet (December 20, 2016)

Updated below: 12/21/16 {thrice}.

1. John Carroll, Endpoints News, December 20th, "Bristol-Myers doubles down on PsiOxus in $936M-plus “armed” oncolytic virus deal:"

"Amgen has helped pioneer the field with its approval of Imlygic (T-Vec), but PsiOxus and a growing lineup of upstarts on both sides of the Atlantic are following systemic infusions for next-gen programs that promise to do significantly better."The "field" above is oncolytic virus (OV) (as opposed to oncolytic immunotherapy, or intralesional therapy). PsiOxus appears to be exploring predominantly or exclusively systemic delivery.

2. NG-348's mechanism of action (the OV compound Bristol-Myers licensed above):

|

| Click to enlarge. Tweet image source |

"PURPOSE: To investigate whether rose bengal dye at a concentration of 1% has a toxic in vivo effect on the human corneal epithelium...

CONCLUSIONS: The appearance of green microdots after the application of rose bengal was probably due to the interruption of intercellular junctions and the penetration of fluorescein stained fluid below the superficial cells. Whether this phenomenon reveals an unhealthy corneal surface and thus has a clinical significance has to be further investigated."See "Rose Bengal 1% Ophthalmic Solution."

PV-10, Provectus' lead oncology compound, is a 10% solution of Rose Bengal. PH-10, the company's lead dermatology compound, is a 0.001% to 0.01% gel of the active pharmaceutical ingredient.

Vimuth:

"Dyes which are discharged from textile industries are major cause for environmental contamination. Most of the dyes are made to be chemically stable and highly persistent in environment. The wastewater released from textile industries contains highly colored pigments causes serious impact not only on aquatic life but also human beings by producing carcinogenic effects [1]. Among different types of dyes, xanthene dyes are most widely used and these are characterized by presence of xanthenes nucleus with aromatic groups as chromophore [2]. Rose bengal is an important xanthene dye widely used in textile and photochemical industries whose molecular structure as shown in Figure 1a. It has severe toxic effects on the human health especially on corneal epithelium [3]. This dye is very dangerous when it comes to contact with skin and causes itchiness, irritation, reddening and blistering. It also affects to eyes like inflammation, eye redness, itching etc. [4]."[1] Dutta AK, Maji SK, Adhikary B (2014) γ-Fe2O3 nanoparticles: An easily recoverable effective photo-catalyst for the degradation of rose bengal and methylene blue dyes in the waste-water treatment plant. Mater Res Bull 49: 28-34.

[4] Vinoda BM, Manjanna J (2014) Dissolution of iron in salicylic acid and cation exchange between Fe(II)-salicylate and Na-montmorillonite to form Fe(II)-montmorillonite. Appl Clay Sci 97: 78-83.

I can't seem to conform Vimuth's statement regarding "severe toxic effects on the human health" with the author's supporting information. Nevertheless, I think it is relevant to reproduce the material in this blog news entry.

4. Msg 5598. Denmark. Etc. (who, what, when).

5. I'm led to believe Provectus will have two abstracts at the 26th Conference of the Asian Pacific Association for the Study of the Liver (APASL) in Shanghai in February 2017. For PV-10's two step approach to treating cancer, I wonder if one abstract deals with ablation (step #1) (local) and one deals with immunotherapy (step #2) (systemic); or, if one further discusses the original liver Phase 1 patients, and the second addresses the expanded liver Phase 1 trial patients.

Updated (12/21/16).1: 6. H/t InvestorVillage poster canis_star, "Talimogene laherparepvec in melanoma: Added benefit not proven," German Institute for Quality and Efficiency in Health Care (IQWiG).

Following the approval of intralesional (IL) agent/oncolytic virus (OV)/oncolytic immunotherapy T-Vec (or Imlygic®) in October 2015, which required Provectus' pivotal melanoma Phase 3 trial protocol to be amended (i.e., version 1.2, February 16, 2016), spotty commercial availability of T-Vec has complicated the execution of Provectus' registration study.

|

| Click to enlarge. November 14th 3Q16 business update conference call |

In Australia, for example, it would appear, where T-Vec is approved but not commercially available (it is available for clinical trials using T-Vec run by Amgen), a patient with in-transit melanoma (in transit mets) is considered a candidate for T-Vec as the de facto standard of care (SOC) for this patient population (which also is the same population for Provectus' pivotal trial). Chemotherapy would not be offered to these patients because of the de facto SOC; however, because T-Vec is not commercially available, these patients are steered towards other clinical trials or offered other immunotherapy drugs.

Going forward, there appear to be two geographic-oriented-as-it-relates-to-T-Vec-availability patient recruitment and enrollment tracks. First, where T-Vec is commercially available, like Germany, Provectus Phase 3 trial sites will be set-up, where enrollment is expected to be high. Here, in Germany, T-Vec is both de facto and bona fide SOC -- that is, appropriate for the patient population (i.e., de facto) and commercially available to be offered to these patients (i.e., bona fide).

|

| Click to enlarge. November 14th business update call |

Second, where T-Vec is not approved (and not available at all) (neither bona fide nor de facto SOC), Provectus Phase 3 trial sites will be set-up, like Russia, Argentina, Mexico, Brazil and China.

Of course, questions (among many others) that beg answers from Provectus Dr. Eric Wachter, PhD, would include: when did you know that spotty availability of T-Vec -- and thus the tussle between de facto and bona fide SOC -- would complicate the company's Phase 3 trial?; when did you implement the course correction(s)?; etc.

Although there appears to be no patient stratification requirement for the trial's comparator arm (i.e., not minimum number of patients treated with T-Vec of the investigator's choices), site selection (as it relates to the first track above) appears to be focused on locations (sites, countries) where T-Vec is commercially available.

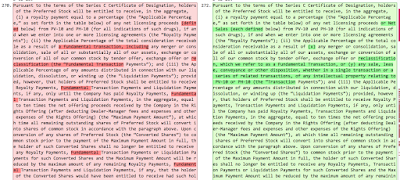

Updated (12/21/16).2: 7. Provectus issued its fourth amendment to its S-1 related to the rights offering to existing investors today. The third amendment is here (filed with the SEC on December 6th). Changes between the two documents (using Diffchecker) include (but are not limited to) the below (third amendment on the left, in red/pink; fourth amendment on the right, in green/light green).

Updated (12/21/16).3: 7b.

Class action (December 15, 2016)Updated (12/21/16).2: 7. Provectus issued its fourth amendment to its S-1 related to the rights offering to existing investors today. The third amendment is here (filed with the SEC on December 6th). Changes between the two documents (using Diffchecker) include (but are not limited to) the below (third amendment on the left, in red/pink; fourth amendment on the right, in green/light green).

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

H/t a regular hatter: The class action settlement appears to have been finalized on December 12th.

|

| Click to enlarge. Screenshot from the document. |

|

| Image source |

Takeaway: '318 combination therapy daughter patent application (continuation of the combination therapy patent, jointly assigned to Provectus and Pfizer), which received a final rejection from the US PTO, has been advanced in the US PTO intellectual property protection process by Provectus.

I previously noted under Hey batta batta batta swing batta batta (October 19, 2016) on the blog's Archived News VI page that in tracking (diligencing) Provectus' intellectual property portfolio, all three daughter patent applications -- that is, all continuations of August 2015-awarded patent Combination of local and systemic immunomodulative therapies for enhanced treatment of cancer (#9,107,887) -- received final rejection notices from the US PTO; '309 (application #14/748,579) on September 23rd, '318 (#14/748,634) on October 12th, and '165 (#14/748,608).

I also wrote at the time that I did not read too much into these final rejections, noting that the process of prosecuting a patent application is a bit like going to bat in baseball, where there are, in general, three strikes before you are out (i.e., receive a final rejection). The are exceptions, however, such as when an examiner makes an office action "final" earlier if he or she feel the application is not advancing prosecution of the case, or when the applicant resets the strike counter by filing a "request for continued examination" (RCE) (which requires remittance of an additional fee to the US PTO).

"Request for continued examination: A request for continued examination (RCE) is a request by an applicant for continued prosecution after the patent office has issued a "final" rejection or after prosecution "on the merits" has been closed (for example by a Notice of Allowance (NOA)). An RCE is not considered a continuing patent application - rather, prosecution of the pending application is reopened. The inventor pays an additional filing fee and continues to argue his case with the patent examiner." (source: "Continuing patent application" Wikipedia pageFurther, I wrote, extending the baseball analogy, an out at a given at-bat does not mean there cannot be additional at-bats, but something has to happen after the out to get another at bat. In Provectus' three cases, I imagined (believed) it would be paying the fees so as to continue claiming what ground the company can in the combination therapy space. The intellectual property game is played first by swinging for the upper deck (i.e., claiming "everything"), which probably leads to a strike, and then second by focusing a bit more, and so on, until an appropriate balance is achieved between the breadth of claims and allowable ones. In particularly difficult examinations, it may even be necessary to abandon the case and follow it up with a continuation, in this case perhaps adding some additional details to the specification that support the desired claims.

I also discussed other aspects of Provectus I.P.P. (portfolio or protection) under Is Pfizer paying more [IP] attention to Provectus? (September 2, 2016), noting that in late-August Provectus and Pfizer advanced '318 (PV-10 + immunomodulatory cancer agents) by providing a response to the US PTO's non-final rejection action through revised claims and that included Provectus- and Pfizer-filed terminal disclaimers.

'318's current status as of December 13th is below:

|

| Click to enlarge. Screenshot from PAIR. |

1. Claim #59 amendment:

|

| Click to enlarge. PAIR screenshot |

|

| Click to enlarge. PAIR screenshot |

|

| Click to enlarge. PAIR screenshot |

Today's announcement by Provectus and the Pediatric Oncology Experimental Therapeutics Investigators Consortium (POETIC) to develop the framework for and then potentially explore the use of PV-10 in pediatric cancer*, Rose Bengal's global pharmacoeconomic value proposition continues to grow both broadly and deeply.

Rhetorical question: If (a) PV-10 is considered an ablative immunotherapy, (b) has shown efficacy (how much may depend on the beholder or observer), and (c) has been used in children as a liver function diagnostic (131I-Rose Bengal) starting in the 1960s, what are the, um, you know, chances it might, um, you know, work safely in pediatric patients?

1963: White et al., PEDIATRIC APPLICATION OF THE RADIOIODINE (I-131) ROSE BENGAL METHOD IN HEPATIC AND BILIARY SYSTEM DISEASE, Pediatrics. 1963 Aug;32:239-50. (Departments of Radiology, Pediatrics, and Surgery of The Children's Mercy Hospital, Kansas City, Missouri)

1972: Effect of Phenobarbital on Hepatic Transport and Excretion of 131I-Rose Bengal in Children with Cholestasis, Thaler et al., Pediatric Research 6(2):100-10 · February 1972.

1973: Diagnosis of extrahepatic biliary obstruction in infants by immunochemical detection of LP-X and modified 131I-Rose Bengal excretion test, Poley et al. Translational Research, March 1973 Volume 81, Issue 3, Pages 325–341.

1974: Mize et al., MATHEMATIC MODELING OF ROSE BENGAL KINETICS: DIAGNOSTIC AID IN NEONATAL OBSTRUCTIVE HEPATIC DISEASE, Pediatric Research (1974) 8, 384–384

* See also December 8, 2016 blog post Rose Bengal (PV-10) + Oncology + Pediatrics.

Fundraising (December 6, 2016)

Updated below: 12/6/16 {thrice}, 12/7/16 {twice} and 12/9/16.

In a filing made today, Provectus amended its prior amended S-1 (November 22nd) to an S-1 that proposes to raise $48.75 million (+ 20% maximum offering) in exchange for preferred stock and a royalty payment of the from net sales of PV-10 and PH-10.

Updated (12/6/16).1: There is a lot to digest in this new financing structure (i.e., the December 6th S-1/A; common stock, preferred stock, royalties) compared to the old one (i.e., November 22nd/November 1st/October 5th; common stock, warrants on common stock). One preliminary or quick reaction for now is this: the royalty structure feels/look like a liquidation preference, where the question I have is whether it (the liq pref) is nonparticipating or participating, and after which existing common stockholders then receive proceeds of value from "Royalty Payments, Fundamental Transaction Payments and Liquidation Payments."

Updated (12/6/16).2: From top to bottom...

- There are no pricing specifics as yet.

- It could be that one (1) unit of this offering would comprise or consist of (a) one (1) share of common stock, (b) one (1) share of Series C Convertible Preferred Stock (convertible into eight (8) shares of common stock), (c) a two- (2-) year, seven percent (7%) per year payable in kind (PIK), cumulative dividend, and (d) some amount of monies from license royalties/transaction payments involving the drug(s) and the company [or some such construct, with specifics to follow of course].

Updated (12/6/16).3: (a) provides the opportunity for offering participants, particularly Maxim clients whose investment style and strategy aligns with such, to sell the common stock portion of the unit so as to lower their cost basis.

- 8% cash fee to Maxim Group. This is the third consecutive financing transaction undertaken by Maxim on behalf of Provectus.

- Nonparticipating liq pref?: "Upon conversion of any shares of Preferred Stock (the “Converted Shares”) to common stock prior to the payment of the Maximum Payment Amount in full, the holder of such Converted Shares shall no longer be entitled to receive any Royalty Payments, Fundamental Transaction Payments or Liquidation Payments for such Converted Shares and the Maximum Payment Amount will be reduced by the maximum amount of any remaining Royalty Payments, Fundamental Transaction Payments and Liquidation Payments, if any, that the holder of the Converted Shares would have been entitled to receive had such holder not converted such shares."

- The so-called Applicable Percentage ladder table:

|

| Click to enlarge |

H/t a shareholder: A discussion with a Memorial Sloan Kettering Cancer Center nurse in a bar (queue the jokes), paraphrasing -- Do you know what Keytruda is? Yes. Do you know what Opdivo is? Yes. Do you know what CAR-T is? Yes. Do you know what PV-10 is? Yes.

Updated (12/6/16).3: A table comparing the changes in the S-1/As

Updated (12/7/16).4: More top to bottom...

Updated (12/6/16).3: A table comparing the changes in the S-1/As

|

| Click to enlarge |

- "PV-10 Melanoma: Phase 3 study in progress: Opened recruitment in U.S. in April 2015; expected expansion from limited sites in U.S. to sites in Europe, Latin America and Asia in 2017 in order to increase enrollment"

- "PV-10 + Pembrolizumab: Phase 1b/2 study initiated September 2015; phase 2 portion expected to commence in 2017"

- "PV-10 Cancers of the Liver:...Phase 1b/2 commencement expected in early 2017"

- "PH-10 Psoriasis (Mechanism of Action): Phase 2 study data being compiled for FDA end of Phase 2 meeting"

- "On the Price Reset Date, the Adjusted Conversion Price was set at $0.0533 pursuant to the terms of the Certificate of Designation. Accordingly, on November 28, 2016, we issued holders who had previously converted their shares of Series B Preferred Stock 112,442,685 shares of common stock pursuant to the price reset provisions in the Certificate of Designation, and we are obligated to issue an additional 6,330,316 shares of common stock, which shares are currently being held in abeyance pursuant to beneficial ownership limitations."

- "On the Price Reset Date, the Adjusted Exercise Price was set at $0.0533 pursuant to the terms of the August 2016 Warrants. No holder of August 2016 Warrants had exercised its August 2016 Warrants prior to the Price Reset Date, so no additional shares of common stock were due to holders of August 2016 Warrants as of the Price Reset Date. Holders of August 2016 Warrants are entitled to exercise their August 2016 Warrants at the Adjusted Exercise Price and will receive an aggregate of 112,564,964 shares of common stock upon exercise of the August 2016 Warrants."

- "Our cash and cash equivalents were $5,178,076 at September 30, 2016, compared with $14,178,902 at December 31, 2015. As of November 30, 2016, we had cash and cash equivalents of $2,627,521."

Updated (12/9/16).6: A cursory perspective, and outsider analysis based merely on math (e.g., a lower average monthly cash burn for October and November), would suggest cash could last through the end of January. This of course begs the question, why the "rush" to undertake the rights offering? Think, and then do. Mostly the same message, different messenger(s) and voice(s).

Updated (12/7/16).5:

- "Our Phase 3 clinical trial of intralesional PV-10 as a melanoma treatment opened to enrollment in the first half of 2015, and we are actively recruiting and treating patients in centers in the U.S. and Australia. We are seeking 225 patients for this study, and although initial enrollment has been unacceptably slow due to evolving care standards and intense competition for patients and investigator resources in our traditional regions of clinical development in the U.S. and Australia, we have initiated steps to expand the study to include a total of 61 centers in the U.S., Australia, Europe, Russia, Latin America and China by the end of 2017; this is a substantial increase from 30 sites in the U.S., Australia and Europe that we projected would be necessary at the start of the study, and reflects the need to compete for patients on a global scale for large, specialized oncology studies. The primary outcome measure is progression-free survival, PFS, to be assessed every 12 weeks up to 18 months. The secondary outcome measures include complete response rate, CRR, and its duration to be set every 12 weeks up to 18 months and overall survival to be assessed every 12 weeks up to 18 months. Unlike our Phase 2 study, which was a single arm study, the Phase 3 study is a randomized trial. And we hope to demonstrate conclusively that PV-10 is both safe and effective and is statistically superior to the control therapy, investigator’s choice of systemic chemotherapy or intralesional oncolytic viral therapy. Our estimated primary completion date is September 2018, and an estimated study completion date of October 2018. This compares to an estimated primary completion date of September 2017, and an estimated study completion date of October 2017, we made at the time of study initiation, and reflects cumulative delays in site startup and patient accrual due to competition for patients and investigator resources and rapidly evolving care standards for melanoma patients in the U.S. and Australia. When 50 percent of the events required for the primary endpoint have occurred, the Independent Data Monitoring Committee will report an interim assessment of efficacy and safety. So, meaningful clinical data could come well before the primary completion date, as documented on clinicaltrials.gov."

|

| Click to enlarge. Prior S-1/A LEFT, Current S-1/A RIGHT |

- "Our lead CRO is coordinating global safety monitoring (pharmacovigilance) appropriate for our growing global clinical operations, and establishment of an independent Clinical Trial Data Monitoring Committee (DMC) to provide independent oversight of our phase 3 melanoma study. The FDA states “A clinical trial DMC is a group of individuals with pertinent expertise that reviews on a regular basis accumulating data from one or more ongoing clinical trials. The DMC advises the sponsor regarding the continuing safety of trial subjects and those yet to be recruited to the trial, as well as the continuing validity and scientific merit of the trial.” The DMC will ensure that our study provides patients with maximum possible safety while protecting the scientific validity and integrity of the data we gather."

|

| Click to enlarge. |

- "In November 2016 at the Society of Immunotherapy of Cancer Annual Meeting in Washington, our collaborators at Moffitt Cancer Center reported preliminary data on combination of intralesional PV-10 with systemic gemcitabine, using murine models of metastatic pancreatic adenocarcinoma. Gemcitabine is a standard chemotherapeutic agent used to treat pancreatic cancer, and the Moffitt team showed that PV-10 ablation of pancreatic cancer tumors led to immunologic activation comparable to that previous reported for melanoma, breast carcinoma and colorectal tumors. Addition of gemcitabine enhanced these effects of PV-10, possibly via suppression of myeloid derived suppressor cells (MDSC), which decrease in response to gemcitabine. Since MDSC have an inhibitory effect on a number of immune effector cells, including CD8+ T cells, dendritic cells and NK T cells, the apparent combination effect could result from reduced immune suppression by gemcitabine coupled with immunologic stimulation by PV-10. According to statistics from the America Cancer Society, over 53,000 new cases of pancreatic cancer are expected in the U.S. in 2016, with 41,780 deaths and a 5-year survival of 8%. What we have learned so far about percutaneous PV-10 injection into liver cancers could have applicability to an exploratory clinical study of this cancer where any progress is likely to be clinically meaningful."

|

| Image source |

InvestorVillage (IV) poster pvct-whale noted the exercise price of warrants issued as part of Provectus' Maxim-led August preferred stock and warrant fundraising, post-price protection calculation or determination, as $0.0533:

"...the Conversion Price of the Preferred Stock has been adjusted from $0.25 per share to $0.0533 per share (the "Adjusted Conversion Price"), and the Exercise Price of the Warrants has been adjusted from $0.275 to $0.0533 (the "Adjusted Exercise Price")."See also Aftermath (November 30, 2016) below.

Bridge building (December 5, 2016)

Intralesional (IL)/oncolytic therapy, melanoma and Rose Bengal/PV-10 key opinion leader (KOL) Dr. Sanjiv Agarwala, MD presented "Innovative combination strategies - oncolytic therapy and systemic immunotherapy approaches" at Melanoma Bridge 2016 in Naples, Italy on December 2nd. He presented "Overview of intralesional oncolytic therapy" at Melanoma Bridge 2015.

Differences and similarities, and notables from the presentations include but are not limited to:

|

| Click to enlarge. LEFT 2015; RIGHT 2016 |

|

| Click to enlarge. LEFT 2015; RIGHT 2016 |

|

| Click to enlarge. LEFT 2015; RIGHT 2016 |

|

| Click to enlarge. 2016 |

|

| Click to enlarge. 2016 |

|

| Click to enlarge. 2016 |

|

| Click to enlarge. LEFT 2015; RIGHT 2016 |

|

| Click to enlarge. LEFT 2015; RIGHT 2016 |

|

| Image source |

Updated below: 11/30/16 and 12/1/16.

1. Maxim's Dan Ballestra and InvestorVillage (IV) poster pvct-whale (aka pvct in cleveland, PVCT Fixer) were originally correct regarding the tradability (lack of restriction) of the so-called ratchet stock and warrants. Someone else was not, despite his excuses or revisionism or parsing to the contrary.

2. IV pvct-whale offered up a calculation of the additional securities potentially issued under the August preferred stock fundraising's price protection as approximately 226 million -- his figure of stock and warrants per million dollars of investment times my use of the $6 million gross proceeds figure. This number would include the original preferred stock as converted into common stock plus warrants (a total of 48 million), which would adjust into the number above (but does not include dividends as shares). IV agrossfarm had estimated approximately 270 million (I cannot easily find the associated IV link), while IV rmgillis had estimated 295 million. As always, I am grateful to other shareholders for posting information that is potentially (likely) accurate (or sufficiently "in the ballpark") and useful.

Provectus has not yet made a filing that reveals the above number; however, with about 305 million shares, options and warrants out prior to the August financing, the potential fully diluted figure as of this writing might be approximately 530 million, leaving about 450-470 million for future needs.

3. What's next boys? [a rhetorical question]

Updated (11/30/16).1: 4. Provectus issued a press release and filed an associated 8-K regarding its stock exchange listing status, Announces Notification of NYSE MKT Listing Deficiency. Of note [to me]:

"The Company is required to submit a plan to the NYSE MKT by December 23, 2016 advising of actions it has taken or will take to regain compliance with the continued listing standards by May 23, 2018. The Company's management is exploring its options moving forward. Currently, the Company intends to submit a plan by the December 23, 2016 deadline."Updated (12/1/16).2: 5. November blog readership stats.

|

| Click to enlarge |

Provectus' special shareholder meeting was held earlier today. The results were available in the morning if you were apprised of them by a shareholder in attendance, and comprised an 8-K filed by the company today. Proposal number 1 was approved 78%-21% (+56%). Proposal number 2 was rejected 47.9%-49.8% (-1.9%), with 2.2% abstaining. See the table below.

|

| Click to enlarge |

I'm led to believe so-called ratchet stock and warrants would be issued to August preferred share fundraising investors on or around November 30th. See Phase 3 guidance (November 21, 2016) below.

Perhaps the rejection of proposal number 2 might hasten a sense of urgency in the independent directors to welcome the assistance of others, and implement a different finance-corporate development-marketing-company culture-etc. plan than the one they're currently carrying out. It's not hard to improve over a blank piece of paper, but I think and believe we can...substantially.

|

| Image source |

Updated below: 11/25/16 and 11/26/16.

1. Juno Therapeutics said this week two more patients died in one of its clinical trials, following three deaths reported in July. See Fortune's November 23rd article "Juno Therapeutics' Shares Sink After 2 More Deaths in Leukemia Drug Trial."

Wikipedia's tumor infiltrating lymphocytes (TILs) page describes TILs as "a type of white blood cell found in tumors." It goes on to say that "TILs are implicated in killing tumor cells. The presence of lymphocytes in tumors is often associated with better clinical outcomes." The National Cancer Institute's Dr. Steve Rosenberg, MD, PhD pioneered the approach of using TILs via adoptive cell transfer (ACT) to treat cancer patients. The American Cancer Society notes that TILs are "immune system cells deep inside some tumors...These T cells can be removed from tumor samples taken from patients and multiplied in the lab by treating them with IL-2. When injected back into the patient, these cells can be active cancer fighters." One company taking this approach of ACT via TILs is Lion Biotechnologies (NASDAQ: LBIO).

Another variation on this concept of ACT is where immune cells originating from a patient's blood (as opposed to his or her tumor) are extracted, altered and put back "with the goal of transferring improved immune functionality and characteristics along with the cells." Peripheral blood T cells are genetically engineered to express tumor-antigen specific T-cell receptors. Companies using this approach include Bluebird Bio (BLUE), Juno Therapeutics (JUNO) and Kite Pharma (KITE). See April 21, 2016 blog post Burning Down The House.

The biggest advantage of ablative immunotherapy -- that is, Rose Bengal and PV-10 -- is the education of the immune system in the proper context, which was a prediction of Provectus' former Chairman and CEO, and a co-founder Dr. Craig Dees, PhD from the beginning of the drug compound's development. The further one strays from in situ activation of the immune system, the greater the risk of unpredictable outcomes.

Provectus CTO Dr. Eric Wachter, PhD previously has conversed about raw hamburger and a well done hamburger. Both are quite different materials along many dimensions, but they both are still hamburger.

Properly destroying cancer tumors means killing only tumors and doing so completely, quickly and, very importantly, safely (that is, leaving healthy tissue unharmed). They believe this approach is the only effective way of sustainably stimulating a person’s natural anti-cancer defenses. Instead of bathing the entire body or even parts of it with radiation, or filling the bloodstream with oral or intravenous chemotherapies or present-day immunotherapies, Dees et al. firmly hold the position that stimulating the immune system is best achieved through treating tumor tissue by injecting into it a drug capable of destroying the entire tumor as quickly as possible without damaging surrounding healthy cells. Completely also means everything from visible tumor tissue to occult or hidden cells in and immediately around the injection site. Quickly means having the drug processed through and excreted from the body in short order. Antigens generated from the tumor destruction caused by drug injection then can be presented to the body’s cells responsible for selecting the best and most relevant antigens in order to encourage cancer-killing cells to replicate themselves throughout the body. Importantly, tumor antigens have to be viewed in context; physical tumor destruction techniques such as heating or freezing tissue destroyed fragile antigens and disrupted their relevant contextual structures. Disruption of cell membranes and removal of lipids, proteins, and complex carbohydrates destroy the antigens’ context, which is to what immune system cells respond. Thermal destruction denatures potential antigens, changing their chemical structure so that they were no longer representative of the tumor cell. In order to work rapid destruction of tumors has to preserve both antigenic structure and biological context.

History: April 2, 2013 blog post $PVCT: Treating Cancer Like An Infectious Disease by Craig Dees.

Juno's issues can have major ramifications for any technology. Eric would argue for Provectus' measured approach to development, which is mostly (but not completely) compelling in regards to the clinical side of the business; however, given the state of the financial side of the business, Eric's argument is mostly insufficient and (as I've mentioned before) not the least bit disconnected.

2. As Eric noted on Provectus' November 14th 3Q16 business update call, spotty availability of Amgen's intralesional (IL) and oncolytic virus (OV) -- oncolytic immunotherapy -- T-Vec has complicated and presumably continues to complicate Provectus' pivotal Phase 3 trial. If PV-10 is approved, I would imagine Eric does not anticipate concern about key headwinds Amgen faced and still faces with T-Vec (e.g., biosafety restrictions for a GMO live virus, a cryogenic supply chain, regulatory clarity, etc.). In the EU, T-Vec was approved based on a subgroup analysis of Stage IIIB-IV M1a patients. It appears that in Australia reimbursement efforts used the U.S. basis for approval (i.e., Stage IIIB-IV M1c patients), which was good for the breadth of IL OV's labeling but complicates its pharmacoeconomics.

3. Where is Allison+Partners?

4. During this year "affiliates" of Provectus -- that is, investigators and sites using PV-10 -- produced the following abstracts, posters and presentations (in chronological order), which was pretty considerable in my view (seven pieces of work):

- Preclinical: PV-10 monotherapy (PV-10 for colon cancer), University of Illinois at Chicago, "PV-10 Induces Potent Immunogenic Apoptosis in Colon Cancer Cells," ASC, February,

- Preclinical: PV-10 combination therapy (PV-10 + checkpoint inhibition for melanoma), Moffitt Cancer Center, "T cell Mediated Immunity After Combination Therapy with Intralesional PV-10 and Co-Inhibitory Blockade in a Melanoma Model," AACR, April,

- Clinical: PV-10 monotherapy (PV-10 for in transit melanoma), (2), Princess Alexandra Hospital and Peter MacCallum Cancer Centre, "Intralesional PV-10 Chemoablation Therapy for the Treatment of Cutaneous Melanoma Metastases - Results of a Prospective, Non-Randomised, Single Centre Study" and "Intralesional PV-10 for In-Transit Melanoma - A Single Centre Experience," respectively, Royal Australasian College of Surgeons 85th Annual Scientific Congress, May,

- Preclinical & clinical: PV-10 mechanism of action, Moffitt, "Intralesional rose bengal in melanoma elicits tumor immunity via activation of dendritic cells by the release of high mobility group box 1," Oncotarget, May,

- Clinical: PV-10 combination therapy (PV-10 + radiotherapy for melanoma), Princess Alexandra Hospital, Australia, "A phase 2 study of intralesional PV-10 followed by radiotherapy for localized in transit or recurrent metastatic melanoma," ASCO, June, and

- Preclinical: PV-10 combination therapy (PV-10 + systemic chemotherapy for pancreatic cancer), Moffitt, "Intralesional Injection with Rose Bengal and Systemic Chemotherapy Induces Anti-Tumor Immunity in a Murine Model of Pancreatic Cancer," SITC, November.

Different voice(s). Same considerable message.

5. Why was there a dearth of new clinical trial data from Provectus in 2016 or, at the very least, clinical trial updates (e.g., enrolment figures, some substantial commentary beyond "interesting," etc.)? I imagine the company was engrossed in building and assuring the company and trial's infrastructure was sufficiently sound to support a global Phase 3 registration study (no small feat), which included (as we learned on the November 14th update call) a major commitment to Europe starting in 2017. Of course, a management shakeup (February) and its long tail did not help.

6. Given number 5 above, however, 2017 would appear to be setting up quite well for at least four Provectus clinical datasets:

"FAQs" (November 22, 2016)- Mechanism of action (PH-10 for psoriasis),

- Monotherapy (PV-10 for liver, expanded Phase 1),

- Combination therapy (PV-10 + checkpoint inhibition for melanoma, Phase 1b), and

- Monotherapy (PV-10 vs. chemotherapy and OV for melanoma, Phase 3 interim data assessment).

Updated (11/25/16): 7. Apparently in keeping with what I noted a couple of times below -- see Pancreatic adenocarcinoma (November 14, 2016) and "FAQs" (November 22, 2016) -- it would appear the retail broker side (e.g., purportedly Dan Ballestra [apparently yet again]) of Maxim Group continue to say to clients (based on multiple reports today, which may be referring to the same conversation with the same broker, or maybe more than one conversation with more than one broker), perhaps among other things, that (i) the additional securities to be issued related to the August preferred share fundraising price protection are unrestricted (the so-called "ratchet stock" [and warrants] to some), (ii) to sell (dump) all ratchet stock and keep [ratchet] warrants, and (iii) if the proposal to provide the board of directors with discretion to undertake a reverse split is not approved, the company will go under.

Updated (11/26/16): 8. Trying to keep it simple, my takeaway for number 7 above is that the rep's/reps' message is straightforward and understandable (from his/their perspective). The message is, one would hope, a fiduciary one to the client, which is the investor or participant in the August preferred stock fundraising (it is not Provectus). (a) If you believe or know the ratchet stock is unrestricted, you blow it out to reduce your cost basis, and then use the ratchet warrants to improve your investment return. (b) The company said it required at least $15 million to complete its pivotal melanoma Phase 3, melanoma combination therapy Phase 1b/2 and liver Phase 1b/2 programs, and was hoping or planning to raise $17.5 million and the 20% oversubscription amount (i.e., a total of $21 million); without a reverse split, it would be difficult to impossible to do so -- thus, if it doesn't raise enough money before a milestone, non-dilutive financing event occurs, it runs out runway and hence goes under. The rep/reps are not rocket scientists (and neither am I).

There is hard work to be done (which mostly refers to non-clinical aspects of the business) to dramatically change the trajectory of the company, but such work can be successfully carried out (but that is not the message the rep/reps are obliged to convey). If only folks would ask for help...

9. Provectus' COO and interim CEO Peter Culpepper did an interview with Small Cap Nation's (SCN's) Jane King, which aired on November 23rd on YouTube:

Of note [to me] (paraphrasing below):

Updated (11/26/16): 8. Trying to keep it simple, my takeaway for number 7 above is that the rep's/reps' message is straightforward and understandable (from his/their perspective). The message is, one would hope, a fiduciary one to the client, which is the investor or participant in the August preferred stock fundraising (it is not Provectus). (a) If you believe or know the ratchet stock is unrestricted, you blow it out to reduce your cost basis, and then use the ratchet warrants to improve your investment return. (b) The company said it required at least $15 million to complete its pivotal melanoma Phase 3, melanoma combination therapy Phase 1b/2 and liver Phase 1b/2 programs, and was hoping or planning to raise $17.5 million and the 20% oversubscription amount (i.e., a total of $21 million); without a reverse split, it would be difficult to impossible to do so -- thus, if it doesn't raise enough money before a milestone, non-dilutive financing event occurs, it runs out runway and hence goes under. The rep/reps are not rocket scientists (and neither am I).

There is hard work to be done (which mostly refers to non-clinical aspects of the business) to dramatically change the trajectory of the company, but such work can be successfully carried out (but that is not the message the rep/reps are obliged to convey). If only folks would ask for help...

9. Provectus' COO and interim CEO Peter Culpepper did an interview with Small Cap Nation's (SCN's) Jane King, which aired on November 23rd on YouTube:

- [1:03] PV-10 can become standard of care for Stage III melanoma if the company's pivotal melanoma Phase 3 trial is successful,

- [3:15] PV-10 research being carried out by National Comprehensive Cancer Network® (NCCN®) centers: Moffitt Cancer Center, The University of Texas MD Anderson Cancer Center, and unnamed (Memorial Sloan Kettering Cancer Center), and

- [5:56] The company can always uplist back onto the NYSE MKT, or uplist onto the Nasdaq, pending news, corporate partnerships, etc. (aka milestones).

I thought it was a useful piece, but its lack of effect (thus far) could serve as a reminder to shareholders the message below is powerful, but the messenger's voice has grown stale, perhaps is tired, and clearly is being ignored by many to most.

|

| Click to enlarge. Image source |

Updated below: 11/22/16 {four times} and 11/23/16.

Provectus posted "frequently asked questions" ("FAQs") related the company's November 14th 3Q16 business update conference call. The answers to the questions in the material provided on Provectus' new website provectusbio.com (the Quarterly Business Update webpage) are cut 'n pastes from the call transcript.

It strikes me this approach, poorly executed because of the cut 'n paste/formatting approach, rather than true, effective and efficient FAQ answers but for fear of their legal shadow I imagine, probably has the goal of focusing existing and prospective shareholders on certain topics management wishes to highlight (I'd normally include the independent directors of the board in also wanting to push a certain [the same] set of topics [an "agenda"], but they're currently asleep at the switch).

Of note [to me] {my underlined emphasis}:

- (Provectus CTO Dr. Eric Wachter, PhD on PH-10) "We expect to have the next and presumably final set of data from those patients available to us for review next month. If that looks good, we will certainly push that towards publication. If it looks good, we'll certainly push that towards meeting with FDA to discuss the consummation of the final steps in this development. If that looks good, we will certainly show that to potential corporate partners. We've already discussed this with one of our potential corporate partners, placing them on notice that that data will be coming."

Updated (11/22/16).1: Provectus' psoriasis Phase 2 study, Randomized Study of PH-10 for Psoriasis, was not powered to be a pivotal trial. The planned or prospective, pivotal psoriasis Phase 3 study [presumably undertaken by PH-10's eventual corporate partner] could have four arms: (i) vehicle (a control), (ii) vehicle + PH-10, (iii) corticosteroid (a topical steroid control) and (iv) corticosteroid + PH-10.

Updated (11/22/16).2: p-values (aka statistical significance). Note the following in Provectus' March 2012 press release of its psoriasis Phase 2c study, Announces Top Line Phase 2 Data For PH-10 in Its First Randomized Controlled Psoriasis Study {my bolded and underlined emphasis}:

"Thirty eight percent of subjects receiving the low dose of PH-10 reported no itching after 28 days compared with 14% of those receiving vehicle (45% of subjects receiving 0.001% Rose Bengal in the earlier study reported no itching after 28 days). PH-10 at 0.002% and 0.005% (along with 0.001% in the prior study) exhibited maximum improvement in Plaque Response Assessment, with the improvements for 0.002% achieving high significance (p < 0.001) after two weeks of treatment..."

Some slides from associated 2012 collateral material:

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

One wonders how much of the historical challenge(s) and delay(s) to arrive at a license transaction have related/relate to, among other things, (i) a solid-to-robust understanding of PH-10's mechanism of action (e.g., there is a clear signal, here is the signal, PH-10 is an immunomodulatory agent in its own right, etc.), (ii) conveying the Rose Bengal-based topical gel's lack of toxicity, and (iii) the rate limiting step(s) of certain humans.

- (Eric on liver mets from melanoma): "I mentioned that we may look at some other targeted and focused areas of tumor type, such as melanoma metastases to the liver. And the expectation there is that that is potentially a new initiative for us in melanoma to provide a faster way to approval in that it is a disease that there is no apparent standard of care. There is no significant response with current classes of agents. And it's an area where the patient population is in desperate need of new solutions, so scenario where we would not be competing with so many other companies if we are able to show relevance there."

- (Eric on approval in Australia): "We are collecting data from that expanded access program. We closed enrollment of new patients effective the end of June of this year. We expect the last treatment of patients to occur prior to the end of December of this year. So, we're collecting those data, but we haven't got a complete dataset from that work yet. And whether that will be adequate to support approval in Australia is a question that we will assess as we have a better, more complete dataset. I will point out this is one area where having a subsidiary in Australia may inure to our benefit now. It focuses us more with Australia. It aligns our efforts more closely with TGA in Australia."

Updated (11/22/16).3: Provectus filed an amended S-1 registration statement today; the last registration statement, also amended, was filed November 1st. I used Diffchecker to compare the two filings. It would appear this new amendment ostensibly conforms the registration statement with the third quarter 10-Q financial and its contents (the original October 5th S-1 filing and the November 1st amendment used the second quarter material).

Additionally, today's amendment notes a response to the NYSE in regards to the potential delisting of the stock (see below) and a lawsuit filed by Provectus against one of three accounting firms the company employed (see further below).

|

| Click to enlarge |

|

| Click to enlarge |

Assuming shareholders approve an increase in the number of authorized shares to 1 billion (proposal no. 1), let's do a back-of-the-envelope sketch of the possible or potential number of shares (and thus units in the upcoming rights offering where I assume one unit equals one share of common stock and one warrant [on common stock]):

- 355 million shares outstanding (including, roughly, the original August preferred share and warrants, and dividends) pre-issuance of additional August-related securities,

- 295 million shares of additional issuance related to the August fundraising (per IV's rmgillis),

- Equalling about 650 million shares outstanding (the current authorized figure is 400 million, subject to the passing of proposal no. 1), and

- Leaving up to about 350 million shares or 150 million units for possible or potential use in the rights offering.

Although I am led to believe the additional securities to be issued to the August preferred stock and warrant holders is restricted [and would have to be registered after some period of time has elapsed, such as at least six months to potentially longer] (some Maxim retail brokers believe otherwise), it's unclear whether both the common stock and warrants (on common stock) to be issued are restricted. It would seem me that both would be restricted (i.e., an early exercised warrant would be exercise into a restricted share of common stock restricted for some period of time thereafter but perhaps with the clock ticking upon issuance of the warrant).

Updated (11/23/16).5: There are three categories of securities related to the August preferred stock fundraising. First, there were preferred shares (convertible into common stock) and warrants (on common stock) that were issued as part of the offering (i.e., money to the company, preferred shares, and warrants to investors who/that made up the offering). These securities were not restricted. Much if not all of the preferred shares were converted into common stock (there would be no point currently to exercise the warrants because the exercise price is too far out of the money. I imagine the common stock that would be issued upon the exercise of the warrants is freely tradeable too.

Second, there are the dividends to be/that have been paid, and which have been paid in common stock, which also are freely tradeable, I also imagine, believe and think.

When I discuss restriction, registration and "144 stock," I only am referring to the additional securities that would (will) be issued upon the calculation of the anti-dilution protection for the August preferred stock fundraising, which would be additional common stock and warrants (on common stock). These, these additional equity securities, I believe are restricted for between 6 months and a year depending on certain variables or parameters that govern the determination of the holding period.

Only time and disclosure will tell. As I previously noted, folks like pvct-whale (aka pvct in cleveland, PVCT Fixer) who [I believe] are discussing this topic with Maxim retail brokers who themselves are unsure (i.e., they, the brokers, think the additional securities are not restricted, but when pressed admit they do not know for sure).

Another question I pose to myself is that the dollar value of the rights offering's fundraise has variables of parameters of the number of units available and the eventual price per unit, which would translate into a certain dollar amount (i.e., 150 million units times 4 cents per unit equals $6 million of gross proceeds). What happens if there an oversubscription on a dollar basis? Would the rights offering process account for that and increase the unit price accordingly (assuming the share price does not increase on its own accord because of news and/or more demand than supply prior to pricing)?

Phase 3 guidance (November 21, 2016)

In nearly every (if not all) regard(s), Provectus is an event-driven company, as most-to-all biotechnology companies are. Provectus, perhaps, is more so (i.e., more event-driven). Existing and prospective shareholders have to get through the following non-clinical events before the prospects of a runway of clinical events or clinical data catalysts present themselves.

i. November 23rd: August preferred share & warrant fundraising anti-dilution protection provision calculation (the "additional shares")

ii. November 28th: Shareholder votes on the proposals of increasing the number of authorized shares, and providing discretion to the board of directors to undertake (if they so deem fit) a reverse split

iii. By or before November 30th: The issuance of the additional shares. While this "catalyst" probably is minor, the determination of how many shares are available for the rights offering (RO) (see iv. below) would come shortly after ii.

iv. December: Pricing and closing of the existing investor RO. The requisite shareholder of record date coming presumably would come at the beginning of the month, with the pricing likely occurring towards the end, and management's roadshow occurring in between. See one of Provectus COO and interim CEO Peter Culpepper's slides from the company's November 14th 3Q16 business update call.

|

| Click to enlarge. Blue dashed arrows are mine |

- February 2017: Expanded liver Phase 1 data (APASL 2017, Shanghai, China),

- 1Q17-: Data, meetings and understanding necessary to generate a PH-10 license,

- 1Q17-: Data, meetings and understanding necessary to generate a co-development relationship to explore the combination of PV-10 and checkpoint inhibition,

- June (September) 2017: Phase 1b melanoma combination therapy data (ASCO 2017, Chicago or ESMO 2017, Madrid, Spain), and

- End of Q2-end of Q3, 2017: Pivotal melanoma Phase 3 interim data readout.

Regarding the last dataset in the list above, Provectus CTO Dr. Eric Wachter, PhD provided an update (on the November 14th update call) regarding a further delay in schedules (that would include, per prior commentary, clinical trial site start-up, trial patient recruitment, and eventual interim and final data readouts):

"I must say, however, that the slow uptake in the U.S. and Australia has set back timelines by an additional six to nine months. We have been working diligently all year to move as fast as possible, to open centers as fast as possible. But, we are playing in a very active clinical development environment right now and have done as best as we could."This revised guidance would suggest an interim data readout between June and September 2017. See the table below.

|

| Click to enlarge |

He merely noted on slide 78 (of the November 14th call's accompanying slide presentation) that timelines were set back by six to nine months.

|

| Click to enlarge. |

|

| Click to enlarge. |

|

| Click to enlarge |

"I don’t believe that we’re trying to communicate guidance on the six to nine months on the interim. The key is, and Eric went through this in detail with all the different sites that are in process of turning up in the different geographies, we need cash through the rights offering to fund that work. The quicker we get up those sites, the quicker we get interim data on top of what we already have, of course, active. So, that’s something to keep in mind that the interim data speed is very much related to the rights offering generating and opening those additional sites." {My underlined emphasis}While Eric may be appearing to provide guidance regarding the potential or possible timing of the Phase 3 interim data readout of 2Q/3Q17, and Peter confirmed as much (according to Danish shareholders in attendance) about a month ago (see An Incomplete Story (October 5, 2016) on the blog's Archived VI page), I would imagine Peter is saying above (and may also have articulated the same appropriate commentary in Denmark) that the faster trial sites are up and running, the faster patients may be recruited, the faster events could or would be generated, and thus the faster an interim data readout might be undertaken.

One has to believe the further six to nine month delay slowed (for the reasons Eric articulated on the call) the uptake of patients in the USA and Australia at the sites noted as recruiting on ClinicalTrials.gov. He noted his mitigation strategy of adding sites in Europe (Germany, Italy, Poland, France) and Latin America (Argentina, Mexico, Brazil); however, I cannot imagine he would be in a position to predict with precision how these EU and LATAM sites were helping to increase the trial's overall enrollment rate until he has experience with these sites.

It is interesting that, as noted on slide 77, Provectus modified pivotal Phase 3 trial protocol earlier this year specifically to address requirements for Germany.

Phase 3 execution (November 18, 2016)

Updated below: 11/19/16 {twice}.

It would seem, for the time being, that every blog post and news entry should have the same byline, rider or caveat regarding Provectus' board of directors and management team: {the makings of a plan, no credibility, poor decision-making, unable to communicate, inefficient and ineffective execute}.

Change (augment) the messenger(s), and I believe, the message and, for the most part (with some tweaking, reconsideration, and/or thoughtful, appropriate and consensus-based [to a point] changes), the plan should resonate with existing and prospective investors.

Now, onto the message behind this news entry...

Provectus CTO Dr. Eric Wachter, PhD provided an update in his slide deck and prepared remarks (as well as presumed webcast-based answers to questions) on the company's pivotal melanoma Phase 3 trial.

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge. |

|

| Click to enlarge |

Eric (or Peter) appears to also have communicated time frames too (see the bottom left-hand side of the webcast screen) in, I believe, chronological order:

"Q: In the presentation, you have indicated that the Phase 3 trial is expected to be pushed out an ADDITIONAL 6 to 9 months. We assume that this is an addition to the 6 additional months that was stated in the 3rd quarter conference call one years ago. Therefore, we would appreciate if you could convert "an additional 6 to 9 months" into a projected date or calendar quarter.

A: Q3 2017 is our current projection

# # # # #

Q: Then when is melanoma P3 interim now expected?

A: We are projecting Q2/Q3 2017

# # # # #

Q: Have any numerical projections been made by the Company's management as to when "interim data" will be available based on the current rate of patient enrollment?

A: We are currently projecting Q2/Q3-2017

I know Eric's words to some have no credibility (and Peter's words to many more have even less). I assume these replies are or come from Eric, who does not publicly give timing but has missed on timing in the past. They have a certain weight or relevance to me, and I can't say they should or could to anyone else.

Finally, related to Eric's comment on the online question portion of the webcast:

Updated (11/19/16).1: Eric's apparent guidance above (i.e., 2Q/3Q17) are in keeping with Peter's comments to Danish investors in early-October. See An Incomplete Story (October 5, 2016) on the blog's Archived VI page.

|

| Click to enlarge. Image source |

Q: Is there any other triggers for P3 interim analysis other than 81 progression events, if so please specify ? based on current estimate you thing we will get 81 progression event by 3Q2017?

A: There are no other triggers

As Eric has noted previously, the trial's Independent Review Committee (IRC) has discretion, and such discretion relates to an imbalance between the events in each of the control and treatment arms. Discretion, a trigger by any other name...

Updated (11/19/16).1: I'm led to believe Alan Ross and [some] Trust Intelligence subscribers may have sold substantial portions of their Provectus holdings this past week.

Updated (11/19/16).2: Provectus filed a supplement to its proxy statement for the upcoming November 28th shareholder meeting and vote on Friday. The supplement is an FAQ of sorts for shareholders. Of note {my underlined emphasis}:

Updated (11/19/16).1: I'm led to believe Alan Ross and [some] Trust Intelligence subscribers may have sold substantial portions of their Provectus holdings this past week.

Updated (11/19/16).2: Provectus filed a supplement to its proxy statement for the upcoming November 28th shareholder meeting and vote on Friday. The supplement is an FAQ of sorts for shareholders. Of note {my underlined emphasis}:

- "How will the approval of Proposal 1 affect our proposed Rights Offering? On October 5, 2016, we filed a registration statement on Form S-1 (as amended on November 1, 2016) with the SEC to issue subscription rights to our existing common stockholders to purchase units consisting of shares of common stock and warrants to purchase shares of common stock (the “Rights Offering”). We are seeking to raise up to $21 million in gross proceeds from the Rights Offering. If we sell all of the units subject to the Rights Offering, we anticipate having sufficient cash on hand to fund all of our research and development and other capital needs through 2017. With the adoption of Proposal 1, we anticipate having a sufficient number of shares of common stock available to undertake the Rights Offering."